Your Financial Education Journey Starts Here

Build practical financial skills through our structured learning pathway. Our nine-month program combines theoretical knowledge with real-world application, preparing you for informed financial decision-making in today's complex landscape.

Financial Foundations

Start with the essentials. We cover budgeting principles, cash flow analysis, and basic investment concepts. You'll learn to read financial statements and understand how different financial instruments work in practice.

Advanced Planning Strategies

Build on your foundation with sophisticated planning techniques. This stage focuses on long-term financial strategy, tax-efficient structures, and portfolio diversification methods that professional advisors use.

Market Analysis & Implementation

Apply your knowledge in real market conditions. Learn to analyze economic indicators, evaluate investment opportunities, and develop strategies that adapt to changing market environments.

Continuous Assessment Process

Your progress is evaluated through multiple touchpoints, ensuring you master each concept before advancing. We believe in thorough understanding rather than rushing through material.

Knowledge Checks

Regular quizzes and concept reviews help reinforce learning and identify areas needing additional focus. These aren't about grades – they're about genuine understanding.

Practical Applications

Apply concepts to real scenarios through case studies and simulations. Work with actual financial data and develop solutions to authentic challenges.

Portfolio Projects

Build a comprehensive portfolio demonstrating your analytical skills. Create financial plans, investment analyses, and strategic recommendations based on realistic scenarios.

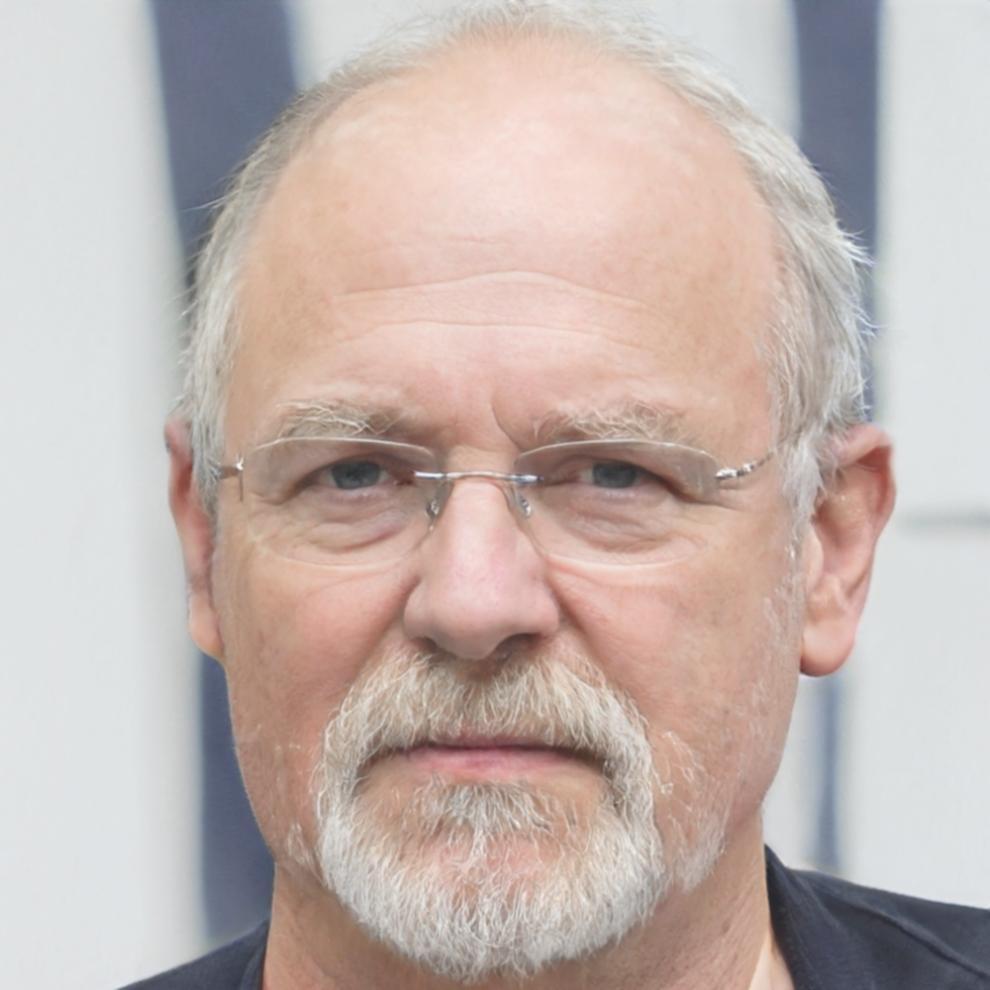

Rachel Morrison

Senior Financial Educator

Former investment analyst with 12 years in portfolio management. Specializes in making complex concepts accessible.

David Chen

Economics Professor

PhD in Economics, published researcher in financial markets. Brings academic rigor to practical applications.

Sarah Williams

Certified Financial Planner

15 years advising high-net-worth clients. Expert in tax-efficient strategies and retirement planning.

Learn From Industry Professionals

Our instructors aren't just academics – they're practicing professionals who understand real-world financial challenges. They've worked with clients, managed portfolios, and navigated market volatility.

Each brings unique perspectives from different areas of finance, giving you a comprehensive view of the industry. Their combined experience covers everything from individual financial planning to institutional investment management.

Discuss Your Learning Goals